In the dynamic world of cryptocurrency, every change in the landscape can ignite intense competition among industry players. As the cryptocurrency community edges closer to the much-anticipated launch of a Bitcoin exchange-traded fund (ETF), leading mining companies like Antminer and Foundry are ramping up efforts to gain dominance in the hash rate war. A higher hash rate signifies greater mining power and influence over the Bitcoin network, a coveted position for miners who are the bedrock of cryptocurrency verification and transaction processes.

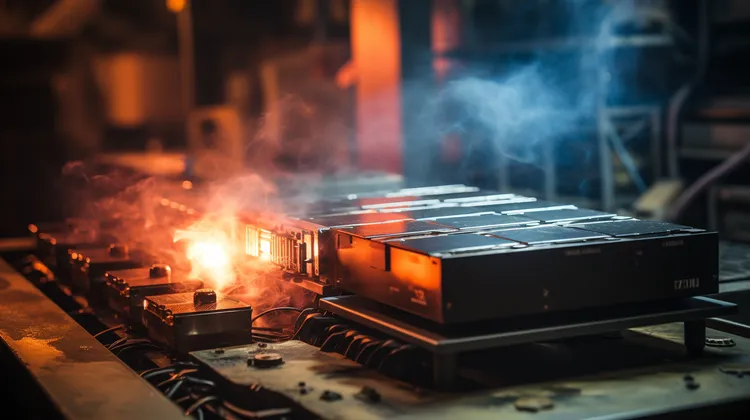

Antminer, a product line of the Chinese company Bitmain, has long been renowned for producing some of the industry’s most powerful mining rigs. The company’s flagship models are recognized for their efficiency and high hash rates, making them favorites among large-scale mining operations. Over the years, Antminer has accumulated significant market share, creating a strong foothold in the mining hardware sector.

Despite this dominance, the American company Foundry, a subsidiary of Digital Currency Group, is quickly emerging as a formidable challenger. Foundry offers a range of services to crypto miners, including equipment financing and a mining pool, which has gained rapid traction. By deploying comprehensive solutions tailored to miners’ needs, Foundry aims to disrupt the market and usher in a new era of mining power distribution.

As competition heats up, both companies are locked in a relentless drive for innovation. Antminer continuously unveils new models with improved energy efficiency and hash rates, striving to retain its market leader status and appeal to environmentally conscious investors concerned about the ecological impact of mining activities. On the other hand, Foundry is leveraging strategic partnerships and its mining pool to aggregate hash rate contributions from multiple sources, thereby bolstering its position in the global mining landscape.

The rise in hash rate among these competitors is not just about gaining profits from mining rewards. It’s also a strategic move as the industry awaits the SEC’s decision on the long-debated Bitcoin ETF. The introduction of a Bitcoin ETF in the United States would likely lead to an influx of institutional investors and an increase in the asset’s liquidity, simultaneously driving up demand for mining power as the network scales.

The hashrate war also has geopolitical implications, as China’s crackdown on cryptocurrency mining has prompted a significant migration of mining operations to more crypto-friendly jurisdictions. This shift presents a golden opportunity for companies like Foundry to capture a larger share of the global hash rate by attracting these displaced miners.

With the looming Bitcoin ETF, both companies understand that a higher hash rate not only serves their economic interests but also positions them as stalwarts of network security. As the underlying asset of the proposed ETF, Bitcoin’s security is paramount, so miners with substantial hash rates play a crucial role in maintaining and securing the network’s integrity.

Market observers believe that the launch of a Bitcoin ETF could also signal a maturation of the market, leading to a reduced volatility and greater mainstream adoption of cryptocurrencies. Therefore, Antminer and Foundry’s investment in the hash rate race is twofold: enhancing their own competitiveness and playing a central role in the evolving narrative of Bitcoin as a mainstream financial asset.

Investors and crypto enthusiasts are closely monitoring the hash rate war, as it not only affects the fortunes of Antminer and Foundry but also has broader implications for the mining industry and the cryptocurrency ecosystem as a whole. Some experts caution, That the concentration of mining power among a few major players could lead to centralization concerns, potentially undermining the decentralized ethos that Bitcoin is built upon.

While Foundry appears to have momentum on its side, the technological prowess and established brand reputation of Antminer cannot be underestimated. The outcome of this hash rate tussle will have significant bearings on the landscape of Bitcoin mining, especially as the market matures and attracts a wider array of participants.

As the cryptocurrency market braces for what could be a transformative event with the introduction of a Bitcoin ETF, Antminer and Foundry are engaging in a strategic faceoff, seeking to cement their leadership in the hash rate rankings. With stakes this high, their rivalry underscores the ever-evolving nature of the blockchain industry, where every advancement can set off a chain reaction of competitive one-upmanship, and every participant vies for a significant role in the future of decentralized finance.

Watching Foundry’s rise has been a rollercoaster. They might just redefine the mining landscape!

The more I hear about hash rates and competition, the more I worry about the centralization of power. Not good.

Is anyone else just overwhelmed by the constant one-upmanship in the crypto space? It’s exhausting and concerning.

The global impact of these mining companies can’t be overstated. What a time to be alive in crypto!

The whole Bitcoin ETF buzz is just a smokescreen for these companies to assert dominance. Not buying into it.

Great, so now we have a battle for the ‘most powerful miner.’ What happened to building a better financial system for everyone?

Seems like the hash rate war is just another way for the big players to monopolize the market. Where’s the decentralization in that?

Watching these giants fight over hash rates is just dizzying. Can we get back to the drawing board and think about sustainability?